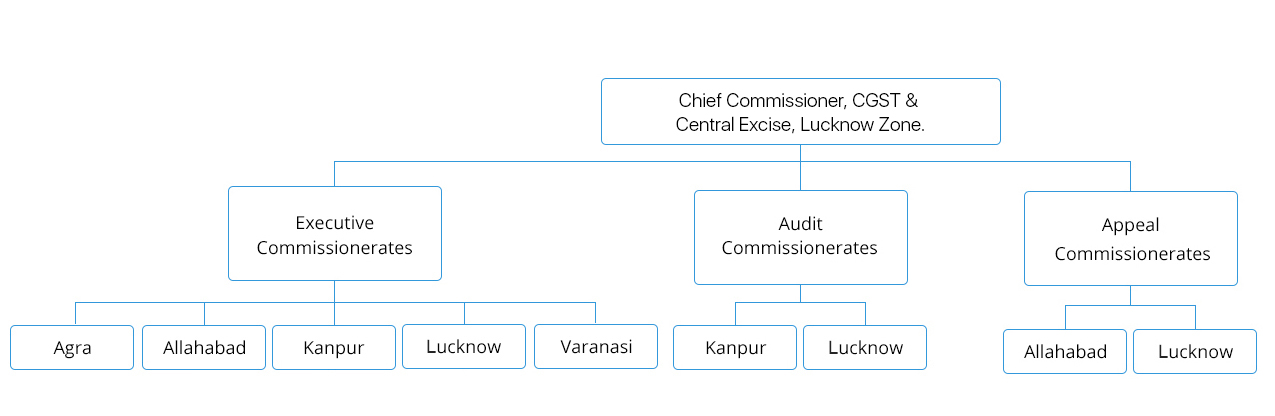

Organization Structure

Central Board of Indirect Taxes and Customs (CBIC) is a part of the Department of Revenue under the Ministry of Finance, Government of India. It deals with the tasks of formulation of policy concerning levy and collection of Customs & Central Taxes, prevention of smuggling and administration of matters relating to Customs, CGST & Central Excise, Service Tax and Narcotics to the extent under CBIC's purview. The Board is the administrative authority for its subordinate organizations, including Custom Houses, CGST & Central Excise Commissionerates and the Central Revenues Control Laboratory.

In terms of Notification No. 2/2017-Central Tax dated 19th June 2017 issued by the Government of India, Ministry of Finance, Department of Revenue, Central Board of Excise and Customs, vide F. No. 349/52/2017- GST, the areas falling under the Jurisdiction of Chief Commissioner of Central Tax, Lucknow has been organized into 5(Five) Central Tax Commissionerates, 2 (Two) Central Tax (Audit) Commissionerates and 2(Two) Central Tax (Appeals) Commissionerates in the state of Uttar Pradesh. Accordingly, the jurisdiction of the Divisions and Ranges under each of the Central Tax Commissionerate, Circles under each of the Central Tax (Audit) Commissionerate.

o/o The Chief Commissioner, CGST & Central Excise, Lucknow Zone.

© CGST 2019 PCCO Lucknow Zone

Last Updated -

`Visitor Counter -

Design By Halwits.com